Long-Term Business Loans in Fort Lauderdale, Miami, Broward & Palm Beach: A Better Way Out of MCA Debt

If you own a business in South Florida, MCA debt can feel crushing. At first, merchant cash advances look helpful. They promise fast money. They seem easy. However, they often cause serious problems.

Thankfully, there is a safer option. Long-term business loans can help you escape MCA debt. Even better, they can improve cash flow and reduce stress.

Let’s keep this simple.

Why Merchant Cash Advances Cause Trouble

Merchant cash advances are quick. That is why many businesses in Fort Lauderdale, Miami, Broward, and Palm Beach use them.

However, speed comes with a price.

First, MCA lenders take money from your account every day or every week. Because of this, your cash flow drops fast. Next, the total payback is very high. In many cases, businesses pay back two or three times what they borrow.

As a result, many owners take another MCA loan just to survive. Over time, this turns into a debt trap.

That is the problem long-term business loans solve.

What Is a Long-Term Business Loan?

A long-term business loan is simple. You borrow money. Then, you pay it back over time.

Unlike MCA loans, these loans offer:

-

Fixed monthly payments

-

Lower costs

-

Clear terms

-

No daily bank withdrawals

Because payments are steady, planning becomes easier.

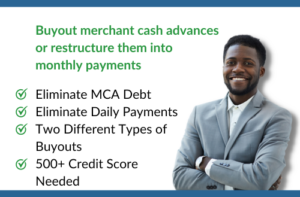

How Long-Term Loans Replace MCA Debt

One big benefit is consolidation. That means one loan pays off many MCA loans.

As a result:

-

Daily withdrawals stop right away

-

Monthly payments drop

-

Cash flow improves fast

-

Stress goes down

Instead of reacting every day, you gain control.

Why South Florida Businesses Choose This Option

South Florida is expensive. Rent is high. Labor costs rise. Sales can change by season.

Because of this, MCA loans hurt local businesses more.

Long-term business loans work well for:

-

Restaurants

-

Retail stores

-

Contractors

-

Medical and service firms

Even better, many programs approve businesses with MCA debt.

Who Can Qualify?

You may qualify if:

-

Your business is at least 6 months old

-

You have steady income

-

You want out of MCA debt

In many cases, tax returns are not needed. Because of that, approvals are fast.

Take Back Control Today

If MCA payments drain your account, now is the time to act. Long-term business loans in Fort Lauderdale, Miami, Broward, and Palm Beach can help you move forward.

Instead of stress, you get stability. Instead of daily fear, you get a plan.

End MCA Debt Now

See if your business qualifies for a long-term business loan that lowers payments and restores cash flow.

👉 Apply for a free review today

👉 No daily payments • Fast approvals • South Florida experts

Please see all of our good reviews on the Better Business Bureau