Most Popular Services

No Doc Loans & Lines of Credit

For Self-Employed, 1099 Contractors, LLC’s and Corporations.

No financials are needed

No taxes are needed

Funding in one week

650+ credit score required

Business Loans & Lines of Credit

Working capital loans and lines under the EIN number not MCA’s

Long term financing up to 10 years

Working capital loans and lines

All industries are eligible

Amounts up to $10,000,000

600 + credit score required

Merchant Cash Advance Buyout Loans

Private investor & hedge fund buyouts into monthly payments

No more daily or weekly payments

No more MCA credit stacking

Immediate cash flow savings

Restructure your high interest debt

Discover all our funding options.

Things to note

Highlights

- PRIVATE INVESTOR FINANCING TO 100 MILLION

- VENTURE CAPITAL FINANCING TO 100 MILLION

- BUSINESS LOANS UNDER YOUR EIN NUMBER

- A+ BBB ACCREDITED BUSINESS

15

Years in Business

100Mil lion

Biggest Loan Amount

1,875

Businesses Funded

Why Business Owners Choose Us

At Unsecured Finances, we provide personalized financial solutions to businesses seeking funding to grow.

We work mostly in the B2B realm either by helping current business owners secure capital, or by helping start up businesses get off the ground. We have over 15 years of experience and are based out of Fort Lauderdale Florida with an A+ certification from the BBB.

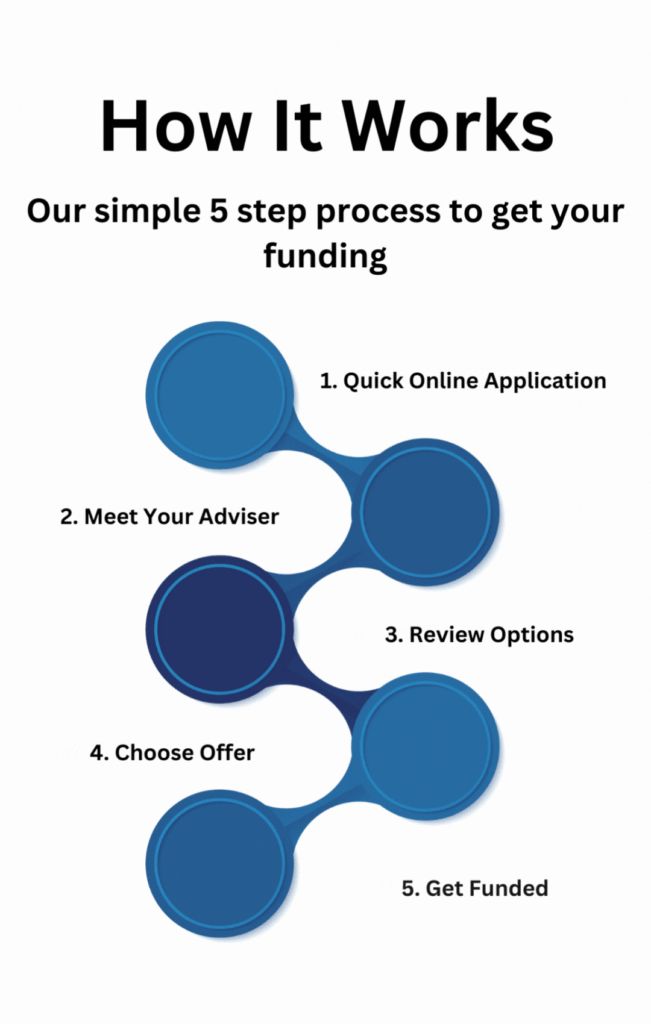

Our easy and fast online application process makes it possible for business owners to receive funding in as little as 48 hours. We also provide exceptional customer service to ensure that business owners have all the support they need throughout the funding process.

Applying is free and will not affect your credit