Merchant Cash Advance (MCA) debt can feel overwhelming. At first, an MCA looks helpful. It gives fast cash when your business needs it most. However, over time, the high fees and daily withdrawals can hurt your cash flow. As a result, many business owners feel stuck and stressed.

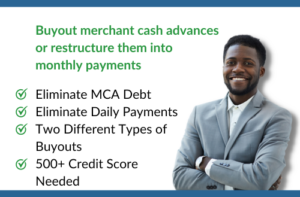

Fortunately, MCA debt consolidation can help. More importantly, it can give your business room to breathe again.

What Is MCA Debt Consolidation?

Simply put, MCA debt consolidation means combining multiple MCA payments into one loan. Instead of paying several lenders every day or week, you make one monthly payment.

Because of this, your finances become easier to manage. In addition, your cash flow improves. Most importantly, you gain peace of mind.

At UnsecuredFinances.com we help business owners replace costly MCA debt with simpler and more manageable solutions.

Why MCA Debt Becomes a Problem

At first, MCAs feel convenient. However, they often come with very high factor rates. Over time, daily withdrawals drain your account. Then, business owners take another MCA to stay afloat. Unfortunately, this creates a cycle of debt.

As a result:

-

Cash flow becomes tight

-

Stress increases

-

Growth slows down

Because of this, consolidation becomes a smart next step.

Benefits of MCA Debt Consolidation

First, consolidation simplifies your payments. One payment is easier than many. As a result, bookkeeping becomes less stressful.

Next, consolidation can lower your overall cost. While MCAs are expensive, consolidation loans often have better terms. Therefore, you may save money over time.

In addition, your payment schedule becomes predictable. This makes planning easier. Because of that, you can budget with confidence.

Finally, consolidation helps you focus on growth. Instead of worrying about lenders, you can focus on running your business.

How the Consolidation Process Works

First, list all your MCA balances. Include payment amounts and lenders.

Next, work with a company that understands MCA debt. At UnsecuredFinances.com we review your situation carefully. Then, we match you with a consolidation option that fits your business.

After that, your MCAs are paid off. From that point on, you make one simple monthly payment.

As a result, your business becomes more stable and less stressed.

Is MCA Debt Consolidation Right for You?

If you are:

-

Making daily or weekly MCA payments

-

Struggling with cash flow

-

Feeling overwhelmed by multiple lenders

Then consolidation may be the right move.

Every business is different. That is why working with an experienced team matters. At UnsecuredFinances.com we help business owners choose smart, realistic solutions.

Final Thoughts

MCA debt does not have to control your business. With the right plan, you can simplify payments, reduce stress, and move forward with confidence.

If you are ready to take control, visit UnsecuredFinances.com today. Speak with a specialist and learn how MCA debt consolidation can help your business move forward.

Please read how we helped clients get out of MCA debt on our google reviews