How to Refinance a Merchant Cash Advance and Save Money

Merchant Cash Advances (MCAs) help small businesses get cash fast. They provide money quickly. In return, the lender takes a part of your daily deposits or credit card sales. However, MCAs often cost much more than traditional loans.

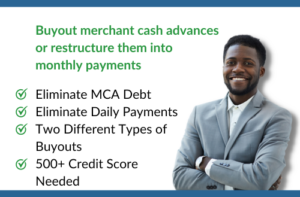

As a result, many business owners ask: Can you refinance a Merchant Cash Advance? The answer is yes. But, it requires careful planning.

What is MCA Refinancing?

Refinancing an MCA means getting a new loan to pay off the old one. Usually, the new loan has lower costs or better repayment terms. In other words, you replace a short-term, expensive loan with something safer.

MCAs often have high fees. For example, some have APRs over 100%. Therefore, refinancing can save your business money. In addition, it helps improve cash flow and gives you more control over finances.

How MCA Refinancing Works

-

Check Your Current MCA

First, review your agreement. Note your daily payment, total balance, and remaining term. This way, you know if refinancing is right for your business.

-

Look at Other Loan Options

Next, consider traditional loans, SBA loans, or lines of credit. These options usually have lower interest rates and longer repayment terms.

-

Pay Off the MCA

After approval, use the new loan to pay off the MCA in full. Otherwise, partial payments could trigger extra fees.

-

Adjust Your Payments

Finally, monthly payments replace daily deductions. As a result, your cash flow becomes easier to manage.

Benefits of Refinancing an MCA

-

Lower Costs: Traditional loans cost less than MCAs.

-

Predictable Payments: Moreover, monthly payments are easier to plan.

-

Better Cash Flow: You keep more money in your business.

-

Future Opportunities: In addition, refinancing can improve credit and help qualify for larger loans later.

Drawbacks to Consider

-

Qualification Rules: Not all businesses can get a loan. For example, lenders may require good credit, steady revenue, and time in business.

-

Fees: Some loans have setup or processing fees.

-

Time: Traditional loans take longer to fund than MCAs. Therefore, access to cash may be delayed.

Other Options

If refinancing is not possible, consider:

-

Negotiate With Your MCA Lender: Some lenders may lower fees or adjust terms but most don’t without an attorney

-

SBA or Term Loans: They take longer but cost much less. Thus, they are a smart option for long-term planning.

Conclusion

Yes, you can refinance a Merchant Cash Advance. However, careful planning is key. The goal is to replace a high-cost, short-term loan with a cheaper, more predictable option. As a result, refinancing can reduce stress, protect cash flow, and help your business grow.

Takeaway:

Refinancing an MCA is more than paying off debt. In addition, it helps you regain control of your finances, save money, and improve your business. Therefore, review your options carefully and choose the one that works best for you.

Unsecuredfinances.com is accredited with the Better Business Bureau (BBB). Please see all of our good reviews.