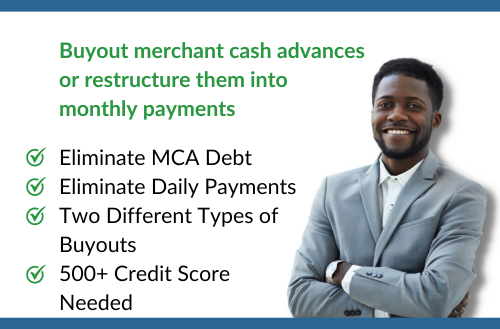

Merchant Cash Advances (MCAs) have become a popular option for small businesses that need fast access to capital. While MCAs provide quick funding, they often come with high costs, steep interest rates, and daily repayment schedules that can put serious pressure on cash flow. Thankfully, businesses caught in this cycle have an effective solution: MCA buyout loans.

In this guide, we break down how MCA buyouts work and why they are becoming a reliable financial strategy for business owners looking to regain control, stabilize cash flow, and grow with confidence.

Understanding MCA Buyouts

A Merchant Cash Advance is a financing method where a business receives a lump sum in exchange for a percentage of its daily credit card or bank deposits. Although this structure offers speed and flexibility upfront, the daily withdrawals can quickly become overwhelming—especially during slow revenue periods.

MCA buyout loans, offered by trusted financial institutions such as Unsecured Finances, allow business owners to refinance or replace their existing MCAs with a more affordable and manageable loan.

Key Functions of an MCA Buyout

Debt Consolidation

An MCA buyout combines multiple MCAs into one single loan. This simplifies payments, reduces stress, and eliminates the confusion of dealing with several lenders at once.

Lower Overall Costs

MCAs often carry extremely high effective APRs due to factor rates. MCA buyout loans usually come with lower interest rates, helping businesses significantly reduce the total cost of borrowing.

Flexible Repayment Terms

Unlike MCAs that require daily or weekly payments, buyout loans typically offer monthly repayment options. This flexibility allows business owners to manage cash flow more efficiently and plan.

How the MCA Buyout Process Works

The MCA buyout process is straightforward and designed to minimize disruption to your business operations.

Initial Assessment

The lender reviews your current MCAs, repayment terms, and overall business financial health to determine buyout eligibility.

Loan Application

Once approved for consideration, the business owner applies along with financial documents and MCA details.

Approval & Terms

If qualified, the lender approves the MCA buyout loan and provides new terms, including interest rate and repayment schedule.

MCA Settlement

The lender pays off the existing MCAs directly, closing those accounts. Your business now carries only one loan.

Repayment

You begin repaying the new loan under more affordable and flexible terms, usually every month.

Benefits of MCA Buyout Loans

MCA buyouts offer meaningful advantages for small business owners:

1. Financial Relief: Reduced payment pressure compared to daily MCA withdrawals

2. Lower Financing Costs: Improved rates help save money long term

3. Improved Cash Flow: Predictable payments allow better financial planning

4. Simplified Debt Management: One loan, one payment, one lender

Final Thoughts

MCA buyout loans can be a powerful solution for businesses struggling with the burden of high-cost Merchant Cash Advances. By refinancing into a single, flexible loan, business owners can regain control over their finances, stabilize cash flow, and focus on growth instead of survival. If daily repayments are holding your business back, exploring an MCA buyout could be the turning point toward long-term financial success.

Thinking of Starting a New Business?

There has never been a better time to turn your entrepreneurial vision into reality. Today’s business landscape offers countless opportunities for startups and growing enterprises. With the right financial support, your ideas can become profitable ventures.

Many aspiring business owners face financial limitations, but there are alternatives beyond personal savings. If you have strong credit and a solid plan, Small Business Loans and No-Doc Loans may be available to help you get started. At Unsecured Finances, our mission is to educate and guide business owners toward the right funding solutions. We provide access to financial resources that help turn business dreams into reality.

Unsecured Finances brings over 10 years of experience in financial consulting. We specialize in helping clients secure:

1. Unsecured Business Loans

2. Unsecured Start-Up Business Loans

3. No-Documentation (No-Doc Stated Income) Loans

4. Business Lines of Credit

Loan amounts range from $10,000 to $500,000, all without requiring assets or collateral.

Apply on our website to find out if you qualify, or call today for a free consultation: 1-888-294-2584